The global magnetic resonance imaging market size was estimated at USD 6.64 billion in 2023 and is anticipated to grow at a compound annual growth rate (CAGR) of 6.5% over the forecast period. Magnetic resonance imaging (MRI) is a highly effective diagnostic tool for identifying conditions associated with spinal lesions, tumors, as well as strokes affecting blood vessels and the brain. The increasing prevalence of these diseases is expected to play an important role in the market growth. For instance, according to the National Center for Health Statistics, in 2023, almost 1,958,310 new cancer cases and 609,820 cancer deaths are estimated to occur in the U.S. In addition, the growing demand for quick and effective diagnostic procedures is expected to contribute to the adoption of MRI machines. Various countries are installing these machines.

As per OECD, in 2021, the number of MRI units installed in the U.S. was 38 per million population. Constant technological advancements, such as the integration of artificial intelligence (AI) in MRI, are further expected to contribute to the overall market growth. For instance, in August 2023, FUJIFILM Healthcare Americas Corporation received U.S. FDA clearance for its 1.5 Tesla MRI system, the ECHELON Synergy. The system utilizes Synergy DLR, a technology developed by Fujifilm that leverages artificial intelligence (AI) for Deep Learning Reconstruction (DLR). This technology enhances image sharpness and accelerates scanning, resulting in improved throughput, image quality, and patient satisfaction. Most of the recent advancements in MRI technology have primarily focused on software improvements.

Furthermore, the introduction of MRI systems that are compatible with cardiac pacemakers is anticipated to drive market expansion within the cardiology segment. MRI manufacturers have continued to innovate with newer technology and AI-based solutions. This helped radiologists to effectively and efficiently understand COVID-19-related diseases and residual symptoms. Magnetic resonance imaging is expected to play a crucial role, as clinicians monitor patient recovery and look for the underlying reasons for long-term COVID-19 symptoms. Despite the growing need for MRI machines in the diagnosis of COVID-19, the reduction in diagnostic screening (a decline of 47.5% was observed in 2020 compared to 2019) hampered the market growth in 2020.

Moreover, economic setbacks led to the reduced sales of newer machines by end-users, and a halt in logistics & national lockdowns also reduced the production capacity of market leaders. However, the market recovered in the Q2 of 2022. Various recent advancements, such as diffusion and diffusion tensor imaging with tractography, neuroimaging including MR spectroscopy, perfusion imaging, and functional imaging using the bold technique are expected to boost the market growth during the forecast period. Also, the growing development of intraoperative MRI and its usage in various applications, such as neurosurgery, is expected to propel the market growth during the forecast period. Moreover, diffusion-weighted MR imaging is mainly used to detect stroke within 30 minutes of its occurrence.

Therefore, advancements in MRI machines to enhance their usage for various applications are expected to drive market growth during the forecast period. Various recent innovations, such as diffusion and diffusion tensor imaging with tractography, perfusion imaging, neuroimaging techniques including MR spectroscopy, and functional imaging employing the BOLD technique, are anticipated to significantly bolster magnetic resonance imaging market growth in the coming years. Furthermore, the increasing development of intraoperative MRI and its diverse applications in fields like neurosurgery are expected to drive market growth during the forecast period. In addition, diffusion-weighted MR imaging is primarily utilized for the rapid detection of strokes within 30 minutes of onset.

Therefore, ongoing advancements in MRI technology geared towards enhancing its utility across various applications are poised to be a driving force for market growth in the foreseeable future. Despite of various advantages associated with the MRI system, the costs incurred in buying and installing these machines are significant, which, in turn, is impacting the market growth, especially in the developing regions. The average cost of a low- to mid-strength machine is more than USD 1 million. In addition, the increasing requirement of depleting deposits of helium gas for cooling of MRI machines is resulting in increasing wait time and is reducing productivity. Delayed product approval and frequent product recalls, mainly due to stringent regulatory framework, are also majorly impacting the market growth.

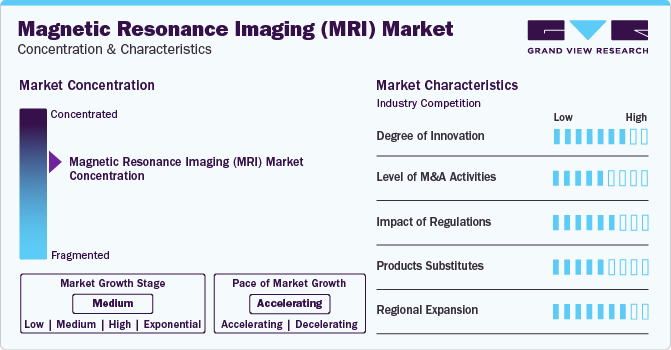

Market growth stage is medium, and pace of the market growth is accelerating. The magnetic resonance imaging market is characterized by a medium to high degree of growth owing to increasing technological advancements, rising preference for early disease diagnosis, continuous R&D efforts from the major market players to launch effective products, increasing regulatory approvals from the regulatory authorities and favourable reimbursement policies. With the rise in chronic diseases such as cancer, cardiovascular diseases, neurological disorders, and musculoskeletal disorders, demand for technologically advanced MRI equipment such as high-resolution imaging and faster scanning times is driving.

Key strategies implemented by players in magnetic resonance imaging market are new product launches, expansion, acquisitions, partnerships, and other strategies. In November 2023, Koninklijke Philips N.V., introduced the BlueSeal MR Mobile at #RSNA23 (Radiological Society of North America). It is the world's first mobile 1.5 T fully sealed MRI system with helium-free operations. The BlueSeal MR Mobile is more agile and lightweight so that it can be located conveniently for patients.

The degree of innovation in the MRI market is high owing to technological advancements. These innovations have improved the quality of healthcare and made MRI machines more accessible to a wider range of patients. As a result, the MRI market is experiencing significant growth, with an increasing number of hospitals, clinics, and diagnostic centers investing in these machines to provide better patient care.

The level of merger & acquisition in the MRI market is moderate. Key players undergo mergers and acquisitions to expand product portfolios and increase their market share. It leads to increased competition among the other market players that drives innovation and improves product and service quality. For instance, the global digital pathology business, including its Dynamyx digital pathology system of Inspirata, was acquired by Fujifilm in February 2023.

Theimpact of regulatory policies is high on the magnetic resonance imaging market due to safety concerns surrounding the use of magnetic fields and radio waves. Changes in regulatory policies, such as the requirement for increased safety measures or the introduction of new regulations, can impact the development, manufacturing, and distribution of MRI machines. Additionally, changes in regulatory policies can also impact the adoption of new MRI technologies, such as the use of contrast agents or the development of new imaging techniques.

The external substitutes for magnetic resonance imaging include computed tomography (CT) scans, X-rays, ultrasound, and positron emission tomography (PET) scans. While these imaging techniques have their own strengths and applications, they are often used in place of MRI, depending on the specific diagnostic needs of the patient.

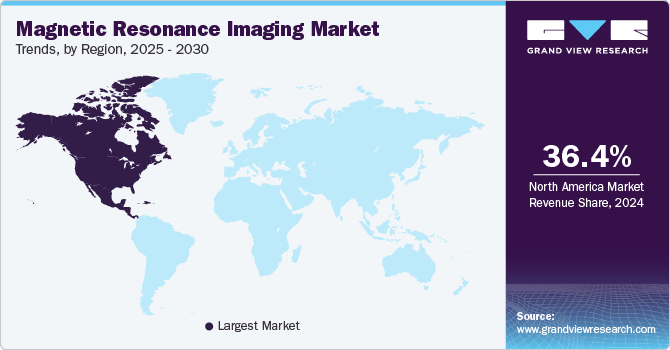

Regional Expansion: The geographical expansion of MRI systems is moderate to high owing to the higher adoption of MRI systems in developed economies such as the U.S. and Japan. However, due to limited healthcare access, lack of regulations, and poor healthcare infrastructure, the adoption of MRI systems is comparatively lower in underdeveloped or developing economies. As per the OECD report, Japan had the highest number of MRI units in 2020, accounting for 57.4 units per million population, followed by the U.S. with 38.0 units per million population. On the other hand, Mexico had the lowest number of MRI units with only 2.9 units per million population.

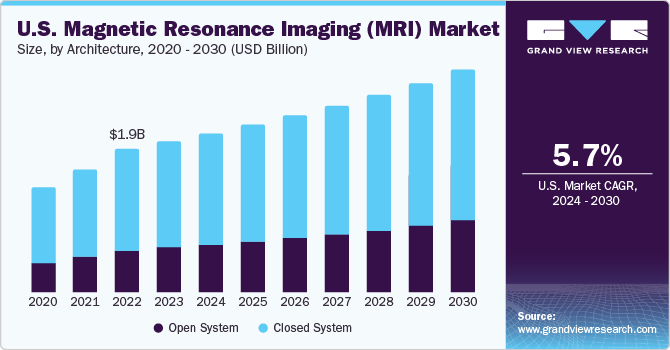

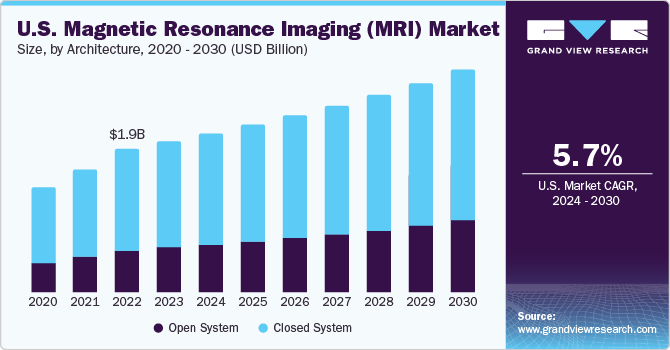

The closed MRI system segment held the largest share of more than 75.47% in 2023. Closed MRI systems employ strong magnetic fields and high-frequency radio waves to acquire highly detailed images. The enclosed design enables precise selection of image slices and ensures error-free analysis. However, patients undergoing closed MRI scans may experience feelings of claustrophobia and discomfort, often exacerbated by the loud noise generated during the procedure. These issues can potentially lead to less accurate results. In response to these challenges, certain market players are dedicating efforts to develop wide-bore and open MRI systems that are better suited for claustrophobic patients. In addition, some manufacturers of pediatric MRI machines incorporate drawings and cartoons on the MRI machines to help soothe children undergoing scans, making the experience more comfortable for them.

Open MRI systems are expected to grow at the fastest CAGR of 7.7% during the forecast period, mainly due to their less enclosed design, which reduces patient anxiety and claustrophobia. This characteristic makes open MRI systems particularly effective for diagnosing neonates. However, closed MRI systems remain the preferred choice for radiologists. Numerous clinical trials are currently underway to assess the efficiency of open MRI systems in diagnosing diseases in neonates. In December 2021, FUJIFILM Healthcare introduced the Velocity MRI System, featuring an open gantry. This advanced and high-field open MRI system is designed to enhance operational efficiency and improve the overall patient experience. Consequently, the ongoing clinical trials and the launch of open MRI systems are expected to drive growth in this segment throughout the forecast period.

MRI machines are categorized based on their field strength, with low-field strength MRI machines having a field strength lower than 1.5T, mid-field MRI machines ranging from 1.5T up to 3T, and high-field MRI machines with a field strength exceeding 3T. The mid-field strength segment held the largest share of 47.70% in 2023 and is projected to undergo substantial growth over the forecast period. Machines with mid-level field strength are favored for their ability to capture high-precision images and are often available at more affordable prices, making them a popular choice among healthcare providers. The high-field segment is expected to experience the fastest growth rate of 7.9% during the forecast period.

Numerous research studies are underway to assess the effectiveness of high-field strength MRI machines across various clinical applications. These advanced machines are being deployed in hospitals and research centers. For example, in May 2023, Researchers at the University of Florida installed a 7 Tesla MRI/MRS preclinical scanner, supported by a generous USD 2 million NIH High-End Instrumentation Award At present, 7T MRI machines find their primary use in brain and knee imaging due to the absence of advanced coils required for other clinical applications. The anticipated development of advanced coils to broaden the scope of applications for 7T MRI machines is expected to be a significant growth driver of this segment during the forecast period.

The hospital segment held the largest share of 37.87% in 2023 due to the increasing installation of MRI units in hospitals. The growing utilization of rapid MRI (rMRI) in emergency care and trauma centers, as well as the rising number of MRI installations in teaching hospitals, are expected to be significant factors propelling the growth of this segment. The imaging centers segment is anticipated to exhibit the fastest growth rate of around 7.8% during the forecast period. The increasing demand for non-invasive diagnosis is driving the establishment of various independent centers that offer services, such as MRI.

To meet this rising demand, many medical professionals are starting their own facilities that provide affordable MRI services. This trend is contributing to the adoption of MRI in the realm of medical services, and as a result, is expected to drive growth in this segment during the forecast period. The ambulatory care centers segment is also expected to grow at a significant rate. This growth can be attributed to the increasing number of government initiatives aimed at enhancing and expanding the number of ambulatory care centers, particularly to extend healthcare services to rural areas.

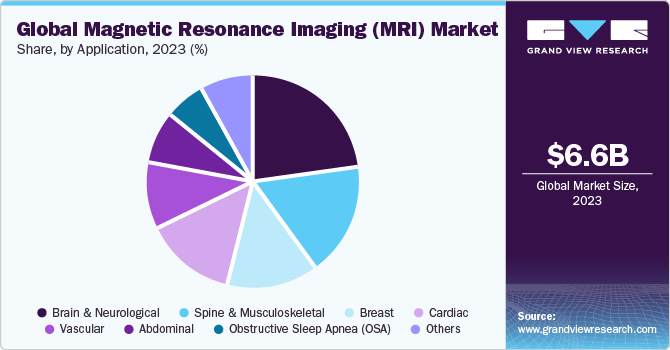

MRI systems used for brain and neurological imaging dominated the market in 2023 and captured a share of around 22.96% of the revenue share. This can be attributed to the quality of scans and superior details as compared to the computerized tomography scans. Similarly, the breast imaging segment is expected to grow at a significant rate as the incidence of this cancer is gradually increasing, which has created the demand for identifying risk factors related to the disease. According to the Global Cancer Observatory, an estimated 2,261,419 new breast cancer cases were diagnosed in 2020 globally, with about 684,996 deaths occurring due to the disease. It is also said to be highly prevalent in females than any other cancer.

Therefore, MRI techniques help provide quantitative information about cancer by identifying the biological and physical properties of tissue. MRI is gaining popularity as the preferred method for spinal and musculoskeletal imaging. It leverages the spin-echo technique to produce high-contrast images that reveal detailed distinctions between the spinal cord and the subarachnoid space. This technique has extensive applications in emergency and trauma care units, enabling comprehensive analysis of internal injuries in soft tissues and the spinal cord. According to data from the Association for Safe International Road Travel, about 20 to 50 million people suffer injuries or become disabled as a result of road accidents every year.

North America dominated the global market by capturing a share of over 36.74% in 2023. The rising prevalence of chronic diseases in this region, including conditions, such as breast cancer, cardiovascular disorders, and neurological diseases, is driving the demand for advanced imaging analysis. This region is projected to continue its dominance throughout the forecast period. The combination of technological advancements along with the increasing incidence of chronic conditions is expected to stimulate the growth of MRI technology during the forecast period.

Asia Pacific is expected to exhibit the fastest growth rate of 7.4% during the forecast period due to the increasing geriatric population and growing demand for advanced imaging modalities. Moreover, the growing medical tourism industry in Asian countries is anticipated to augment the advanced medical imaging industry growth during the forecast period. Countries, such as India, China, and Japan, are creating growth opportunities with rapidly expanding healthcare service industry, presence of skilled healthcare staff, and advanced healthcare facilities and services at a lower cost than developed countries of North America and Europe.

India MRI market is expected to witness the significant CAGR of 8.0% during the forecast period. The market is driven by growing demand for advanced diagnostic technologies and rising prevalence of chronic disorders. Some of the major players in the Indian MRI market include Wipro GE Healthcare, Philips India, Siemens Healthcare Private Limited, and Toshiba India Pvt. Ltd. These companies are investing in R&D activities to develop innovative and cost-effective MRI machines to cater to the increasing demand for advanced diagnostic technologies. In addition, the Indian government is also takes initiatives to promote R&D activities in the healthcare sector. The Department of Biotechnology has set up institutions like BIRAC (Biotechnology Industry Research Assistance Council) to promote innovation and entrepreneurship in the biotechnology sector, including medical devices like MRI machines. For instance, In August 2023, Voxelgrids, an India-based company, launched an affordable MRI scanner that has the potential to revolutionize healthcare accessibility worldwide. The MRI scanner's cost is much lower than its conventional counterparts, making it accessible to billions of people who were previously unable to undergo the procedure due to financial constraints. The project was funded by BIRAC, an institution set up by the Department of Biotechnology in India.

Magnetic resonance imaging market is dominated by few major players such as GE Healthcare; Siemens Healthineers; Koninklijke Philips N.V.; Canon Medical Systems; Hitachi Healthcare; Hologic Inc.; Bruker Corp.; Esaote SPA; Fujifilm Holdings Corp.; Shimadzu Corp.; Aurora Imaging Technologies, Inc. GE HealthCare, Siemens Healthineers, Koninklijke Philips N.V., and Toshiba Medical Systems Corporation have captured around 40% of the MRI market share. Key players are constantly involved in adopting new strategies such as product launch, regulatory approval, partnership and collaboration, expansion, and others. For instance, GE Healthcare announced a 10-year collaboration with the University of Wisconsin School of Medicine and Public Health at UW-Madison on November 2023. The main objective of this collaboration is to expand research in digital technologies and solutions focused on diseases. By combining the expertise of UW-Madison's team of scientists, physicians, and researchers along with the GE Healthcare's modern medical technology, the collaboration aims to enhance the foundation of imaging and medical physics. The development of various modalities such as interventional radiology (IR), magnetic resonance (MR), ultrasound, computed tomography (CT), Theranostics, molecular imaging (MI) and patient care solutions, will help to achieve improved diagnosis and disease management in the future.

Report Attribute

Details

Market size value in 2024

USD 7.05 billion

Revenue forecast in 2030

USD 10.29 billion

Growth rate

CAGR of 6.5% from 2024 to 2030

Actual period

2018 - 2022

Revenue in USD million/billion and CAGR from 2024 to 2030

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Architecture, field strength, application, end-use, and region

North America; Europe; Asia Pacific; Latin America; MEA

U.S.; Canada; UK; Germany; Italy; France; Spain; Sweden; Denmark; Norway; China; India; Japan; Thailand; South Korea; Australia; Mexico; Brazil; Argentina; Saudi Arabia; South Africa; UAE; Kuwait

Key companies profiled

GE Healthcare; Siemens Healthineers; Koninklijke Philips N.V.; Canon Medical Systems; Hitachi Healthcare; Hologic Inc.; Bruker Corp.; Esaote SPA; Fujifilm Holdings Corp.; Shimadzu Corp.; Aurora Imaging Technologies, Inc.

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Magnetic Resonance Imaging (MRI) market report on the basis of architecture, field strength, application, end-use, and region:

b. The global magnetic resonance imaging market size was estimated at USD 6.64 billion in 2023 and is expected to reach USD 7.05 billion in 2024.

b. The global magnetic resonance imaging market is expected to grow at a compound annual growth rate of 6.5% from 2024 to 2030 to reach USD 10.29 billion by 2030.

b. Brain and neurological dominated the MRI market with a share of 22.86% in 2023. This is attributable to factors such as superior quality scans compared to CT imaging.

b. Some key players operating in the MRI market include GE Healthcare, Siemens AG, Toshiba Corporation, Aurora Imaging Technologies, Inc. , Koninklijke Philips N.V., Esaote SPA, Sanrad Medical Systems Pvt ltd, Fujifilm

b. Key factors that are driving the magnetic resonance imaging market growth include advancements in diagnostic techniques, such as open MRI, visualization software, and superconducting magnets.

Request a Free Sample

Table of Contents

Chapter 1. Magnetic Resonance Imaging Market: Methodology and Scope

1.1. Market Segmentation and Scope

1.2. Research Methodology

1.3. Information Procurement

1.4. Information or Data Analysis

1.5. Market Formulation & Validation

1.6. Model Details

1.7. List of Data Sources

Chapter 2. Magnetic Resonance Imaging Market: Executive Summary

2.1. Market Outlook

2.2. Segment Outlook

2.3. Competitive Insights

Chapter 3. Magnetic Resonance Imaging Market: Variables, Trends, & Scope

3.1. Market Lineage Outlook

3.1.1. Parent Market Outlook

3.1.2. Ancillary Market Outlook

3.2. Market Dynamics

3.2.1. Market Driver Analysis

3.2.1.1. Rising patient population

3.2.1.2. Technological advancement

3.2.1.3. Increasing awareness regarding early diagnosis

3.2.2. Market Restraint Analysis

3.2.2.1. High cost of MRI system

3.2.2.2. Depleting helium deposits

3.2.3. Market Opportunity Analysis

3.2.4. Market Challenge Analysis

3.3. Magnetic Resonance Imaging Market Analysis Tools

3.3.1. Industry Analysis - Porter’s

3.3.1.1. Bargaining power of suppliers

3.3.1.2. Bargaining power of buyers

3.3.1.3. Threat of substitutes

3.3.1.4. Threat of new entrants

3.3.1.5. Competitive rivalry

3.3.2. PESTEL Analysis

3.3.2.1. Political & Legal landscape

3.3.2.2. Economic and Social landscape

3.3.2.3. Technological landscape

Chapter 4. Magnetic Resonance Imaging Market: Architecture Estimates & Trend Analysis

4.1. Segment Dashboard

4.2. Magnetic Resonance Imaging Market: Architecture Movement Analysis & Market Share, 2023 & 2030

4.3. Open System

4.3.1. Open System Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

4.4. Closed System

4.4.1. Closed System Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

Chapter 5. Magnetic Resonance Imaging Market: Field Strength Estimates & Trend Analysis

5.1. Segment Dashboard

5.2. Magnetic Resonance Imaging Market: Field Strength Movement Analysis & Market Share, 2023 & 2030

5.3. Low Field

5.3.1. Low Field Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

5.4. Mid Field

5.4.1. Mid Field Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

5.5. High Field

5.5.1. High Field Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

Chapter 6. Magnetic Resonance Imaging Market: Application Estimates & Trend Analysis

6.1. Segment Dashboard

6.2. Magnetic Resonance Imaging Market: Application Movement Analysis & Market Share, 2023 & 2030

6.3. Obstructive Sleep Apnea

6.3.1. Obstructive Sleep Apnea Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

6.4. Brain & Neurological

6.4.1. Brain and Neurological Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

6.5. Spine & Musculoskeletal

6.5.1. Spine and Musculoskeletal Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

6.6. Vascular

6.6.1. Vascular Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

6.7. Abdominal

6.7.1. Abdominal Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

6.8. Cardiac

6.8.1. Cardiac Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

6.9. Breast

6.9.1. Breast Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

6.10. Others

6.10.1. Others Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

Chapter 7. Magnetic Resonance Imaging Market: End-use Estimates & Trend Analysis

7.1. Segment Dashboard

7.2. Magnetic Resonance Imaging Market: End-use Movement Analysis & Market Share, 2023 & 2030

7.3. Hospitals

7.3.1. Hospitals Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

7.4. Imaging Centers

7.4.1. Imaging Centers Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

7.5. Ambulatory Surgical Centers

7.5.1. Ambulatory Surgical Centers Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

7.6. Others

7.6.1. Others Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

Chapter 8. Magnetic Resonance Imaging Market: Regional Estimates & Trend Analysis

8.1. Regional Outlook

8.2. Magnetic Resonance Imaging Market: Regional Movement Analysis & Market Share, 2023 & 2030

8.3. North America

8.3.1. North America Magnetic Resonance Imaging Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.3.2. U.S.

8.3.2.1. Key Country Dynamics

8.3.2.2. Competitive Scenario

8.3.2.3. Regulatory Framework

8.3.2.4. Reimbursement Scenario

8.3.2.5. U.S. Magnetic Resonance Imaging Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.3.3. Canada

8.3.3.1. Key Country Dynamics

8.3.3.2. Competitive Scenario

8.3.3.3. Regulatory Framework

8.3.3.4. Reimbursement Scenario

8.3.3.5. Canada Magnetic Resonance Imaging Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.4. Europe

8.4.1. Europe Magnetic Resonance Imaging Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.4.2. UK

8.4.2.1. Key Country Dynamics

8.4.2.2. Competitive Scenario

8.4.2.3. Regulatory Framework

8.4.2.4. Reimbursement Scenario

8.4.2.5. UK Magnetic Resonance Imaging Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.4.3. Germany

8.4.3.1. Key Country Dynamics

8.4.3.2. Competitive Scenario

8.4.3.3. Regulatory Framework

8.4.3.4. Reimbursement Scenario

8.4.3.5. Germany Magnetic Resonance Imaging Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.4.4. France

8.4.4.1. Key Country Dynamics

8.4.4.2. Competitive Scenario

8.4.4.3. Regulatory Framework

8.4.4.4. Reimbursement Scenario

8.4.4.5. France Magnetic Resonance Imaging Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.4.5. Italy

8.4.5.1. Key Country Dynamics

8.4.5.2. Competitive Scenario

8.4.5.3. Regulatory Framework

8.4.5.4. Reimbursement Scenario

8.4.5.5. Italy Magnetic Resonance Imaging Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.4.6. Spain

8.4.6.1. Key Country Dynamics

8.4.6.2. Competitive Scenario

8.4.6.3. Regulatory Framework

8.4.6.4. Reimbursement Scenario

8.4.6.5. Spain Magnetic Resonance Imaging Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.4.7. Denmark

8.4.7.1. Key Country Dynamics

8.4.7.2. Competitive Scenario

8.4.7.3. Regulatory Framework

8.4.7.4. Reimbursement Scenario

8.4.7.5. Denmark Magnetic Resonance Imaging Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.4.8. Sweden

8.4.8.1. Key Country Dynamics

8.4.8.2. Competitive Scenario

8.4.8.3. Regulatory Framework

8.4.8.4. Reimbursement Scenario

8.4.8.5. Sweden Magnetic Resonance Imaging Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.4.9. Norway

8.4.9.1. Key Country Dynamics

8.4.9.2. Competitive Scenario

8.4.9.3. Regulatory Framework

8.4.9.4. Reimbursement Scenario

8.4.9.5. Norway Magnetic Resonance Imaging Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.5. Asia Pacific

8.5.1. Asia Pacific Magnetic Resonance Imaging Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.5.2. Japan

8.5.2.1. Key Country Dynamics

8.5.2.2. Competitive Scenario

8.5.2.3. Regulatory Framework

8.5.2.4. Reimbursement Scenario

8.5.2.5. Japan Magnetic Resonance Imaging Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.5.3. China

8.5.3.1. Key Country Dynamics

8.5.3.2. Competitive Scenario

8.5.3.3. Regulatory Framework

8.5.3.4. Reimbursement Scenario

8.5.3.5. China Magnetic Resonance Imaging Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.5.4. India

8.5.4.1. Key Country Dynamics

8.5.4.2. Competitive Scenario

8.5.4.3. Regulatory Framework

8.5.4.4. Reimbursement Scenario

8.5.4.5. India Magnetic Resonance Imaging Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.5.5. South Korea

8.5.5.1. Key Country Dynamics

8.5.5.2. Competitive Scenario

8.5.5.3. Regulatory Framework

8.5.5.4. Reimbursement Scenario

8.5.5.5. South Korea Magnetic Resonance Imaging Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.5.6. Australia

8.5.6.1. Key Country Dynamics

8.5.6.2. Competitive Scenario

8.5.6.3. Regulatory Framework

8.5.6.4. Reimbursement Scenario

8.5.6.5. Australia Magnetic Resonance Imaging Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.5.7. Thailand

8.5.7.1. Key Country Dynamics

8.5.7.2. Competitive Scenario

8.5.7.3. Regulatory Framework

8.5.7.4. Reimbursement Scenario

8.5.7.5. Thailand Magnetic Resonance Imaging Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.6. Latin America

8.6.1. Latin America Magnetic Resonance Imaging Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.6.2. Brazil

8.6.2.1. Key Country Dynamics

8.6.2.2. Competitive Scenario

8.6.2.3. Regulatory Framework

8.6.2.4. Reimbursement Scenario

8.6.2.5. Brazil Magnetic Resonance Imaging Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.6.3. Mexico

8.6.3.1. Key Country Dynamics

8.6.3.2. Competitive Scenario

8.6.3.3. Regulatory Framework

8.6.3.4. Reimbursement Scenario

8.6.3.5. Mexico Magnetic Resonance Imaging Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.6.4. Argentina

8.6.4.1. Key Country Dynamics

8.6.4.2. Competitive Scenario

8.6.4.3. Regulatory Framework

8.6.4.4. Reimbursement Scenario

8.6.4.5. Argentina Magnetic Resonance Imaging Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.7. Middle East & Africa

8.7.1. Middle East & Africa Magnetic Resonance Imaging Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.7.2. South Africa

8.7.2.1. Key Country Dynamics

8.7.2.2. Competitive Scenario

8.7.2.3. Regulatory Framework

8.7.2.4. Reimbursement Scenario

8.7.2.5. South Africa Magnetic Resonance Imaging Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.7.3. Saudi Arabia

8.7.3.1. Key Country Dynamics

8.7.3.2. Competitive Scenario

8.7.3.3. Regulatory Framework

8.7.3.4. Reimbursement Scenario

8.7.3.5. Egypt Magnetic Resonance Imaging Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.7.4. UAE

8.7.4.1. Key Country Dynamics

8.7.4.2. Competitive Scenario

8.7.4.3. Regulatory Framework

8.7.4.4. Reimbursement Scenario

8.7.4.5. UAE Magnetic Resonance Imaging Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.7.5. Kuwait

8.7.5.1. Key Country Dynamics

8.7.5.2. Competitive Scenario

8.7.5.3. Regulatory Framework

8.7.5.4. Reimbursement Scenario

8.7.5.5. Kuwait Magnetic Resonance Imaging Market Estimates and Forecasts, 2018 - 2030 (USD Million)

Chapter 9. Competitive Landscape

9.1. Recent Developments & Impact Analysis, By Key Market Participants

9.2. Company/Competition Categorization

9.3. Vendor Landscape

9.3.1. List of key distributors and channel partners

9.3.2. Key customers

9.3.3. Key company market share analysis, 2023

9.4. Key Company Profiles

9.4.1. Koninklijke Philips N.V.

9.4.1.1. Company overview

9.4.1.2. Financial performance

9.4.1.3. Product benchmarking

9.4.1.4. Strategic initiatives

9.4.2. GE Healthcare

9.4.2.1. Company overview

9.4.2.2. Financial performance

9.4.2.3. Product benchmarking

9.4.2.4. Strategic initiatives

9.4.3. Siemens Healthineers

9.4.3.1. Company overview

9.4.3.2. Financial performance

9.4.3.3. Product benchmarking

9.4.3.4. Strategic initiatives

9.4.4. Canon Medical Systems

9.4.4.1. Company overview

9.4.4.2. Financial performance

9.4.4.3. Product benchmarking

9.4.4.4. Strategic initiatives

9.4.5. Hitachi Healthcare

9.4.5.1. Company overview

9.4.5.2. Financial performance

9.4.5.3. Product benchmarking

9.4.5.4. Strategic initiatives

9.4.6. Hologic Inc.

9.4.6.1. Company overview

9.4.6.2. Financial performance

9.4.6.3. Product benchmarking

9.4.6.4. Strategic initiatives

9.4.7. Bruker Corporation

9.4.7.1. Company overview

9.4.7.2. Financial performance

9.4.7.3. Product benchmarking

9.4.7.4. Strategic initiatives

9.4.8. Esaote SPA

9.4.8.1. Company overview

9.4.8.2. Financial performance

9.4.8.3. Product benchmarking

9.4.8.4. Strategic initiatives

9.4.9. Fujifilm Holdings Corporation

9.4.9.1. Company overview

9.4.9.2. Financial performance

9.4.9.3. Product benchmarking

9.4.9.4. Strategic initiatives

9.4.10. Shimadzu Corporation

9.4.10.1. Company overview

9.4.10.2. Financial performance

9.4.10.3. Product benchmarking

9.4.10.4. Strategic initiatives

9.4.11. Aurora Imaging Technologies, Inc.

9.4.11.1. Company overview

9.4.11.2. Financial performance

9.4.11.3. Product benchmarking

9.4.11.4. Strategic initiatives

9.5. Participant Categorization

9.6. Heat Map Analysis/ Company Market Position Analysis

9.7. Strategy Mapping

9.8. List of Other Key Market Players

List of Tables

Table 1 List of Abbreviation

Table 2 North America magnetic resonance imaging (MRI) market, by region, 2018 - 2030 (USD Million)

Table 3 North America magnetic resonance imaging (MRI) market, by architecture, 2018 - 2030 (USD Million)

Table 4 North America magnetic resonance imaging (MRI) market, by field strength, 2018 - 2030 (USD Million)

Table 5 North America magnetic resonance imaging (MRI) market, by application, 2018 - 2030 (USD Million)

Table 6 North America magnetic resonance imaging (MRI) market, by end-use, 2018 - 2030 (USD Million)

Table 7 U.S. magnetic resonance imaging (MRI) market, by architecture, 2018 - 2030 (USD Million)

Table 8 U.S. magnetic resonance imaging (MRI) market, by field strength, 2018 - 2030 (USD Million)

Table 9 U.S. magnetic resonance imaging (MRI) market, by application, 2018 - 2030 (USD Million)

Table 10 U.S. magnetic resonance imaging (MRI) market, by end-use, 2018 - 2030 (USD Million)

Table 11 Canada magnetic resonance imaging (MRI) market, by architecture, 2018 - 2030 (USD Million)

Table 12 Canada magnetic resonance imaging (MRI) market, by field strength, 2018 - 2030 (USD Million)

Table 13 Canada magnetic resonance imaging (MRI) market, by application, 2018 - 2030 (USD Million)

Table 14 Canada magnetic resonance imaging (MRI) market, by end-use, 2018 - 2030 (USD Million)

Table 15 Europe magnetic resonance imaging (MRI) market, by region, 2018 - 2030 (USD Million)

Table 16 Europe magnetic resonance imaging (MRI) market, by architecture, 2018 - 2030 (USD Million)

Table 17 Europe magnetic resonance imaging (MRI) market, by field strength, 2018 - 2030 (USD Million)

Table 18 Europe magnetic resonance imaging (MRI) market, by application, 2018 - 2030 (USD Million)

Table 19 Europe magnetic resonance imaging (MRI) market, by end-use, 2018 - 2030 (USD Million)

Table 20 UK magnetic resonance imaging (MRI) market, by architecture, 2018 - 2030 (USD Million)

Table 21 UK magnetic resonance imaging (MRI) market, by field strength, 2018 - 2030 (USD Million)

Table 22 UK magnetic resonance imaging (MRI) market, by application, 2018 - 2030 (USD Million)

Table 23 UK magnetic resonance imaging (MRI) market, by end-use, 2018 - 2030 (USD Million)

Table 24 Germany magnetic resonance imaging (MRI) market, by architecture, 2018 - 2030 (USD Million)

Table 25 Germany magnetic resonance imaging (MRI) market, by field strength, 2018 - 2030 (USD Million)

Table 26 Germany magnetic resonance imaging (MRI) market, by application, 2018 - 2030 (USD Million)

Table 27 Germany magnetic resonance imaging (MRI) market, by end-use, 2018 - 2030 (USD Million)

Table 28 Spain magnetic resonance imaging (MRI) market, by architecture, 2018 - 2030 (USD Million)

Table 29 Spain magnetic resonance imaging (MRI) market, by field strength, 2018 - 2030 (USD Million)

Table 30 Spain magnetic resonance imaging (MRI) market, by application, 2018 - 2030 (USD Million)

Table 31 Spain magnetic resonance imaging (MRI) market, by end-use, 2018 - 2030 (USD Million)

Table 32 France magnetic resonance imaging (MRI) market, by architecture, 2018 - 2030 (USD Million)

Table 33 France magnetic resonance imaging (MRI) market, by field strength, 2018 - 2030 (USD Million)

Table 34 France magnetic resonance imaging (MRI) market, by application, 2018 - 2030 (USD Million)

Table 35 France magnetic resonance imaging (MRI) market, by end-use, 2018 - 2030 (USD Million)

Table 36 Italy magnetic resonance imaging (MRI) market, by architecture, 2018 - 2030 (USD Million)

Table 37 Italy magnetic resonance imaging (MRI) market, by field strength, 2018 - 2030 (USD Million)

Table 38 Italy magnetic resonance imaging (MRI) market, by application, 2018 - 2030 (USD Million)

Table 39 Italy magnetic resonance imaging (MRI) market, by end-use, 2018 - 2030 (USD Million)

Table 40 Sweden magnetic resonance imaging (MRI) market, by architecture, 2018 - 2030 (USD Million)

Table 41 Sweden magnetic resonance imaging (MRI) market, by field strength, 2018 - 2030 (USD Million)

Table 42 Sweden magnetic resonance imaging (MRI) market, by application, 2018 - 2030 (USD Million)

Table 43 Sweden magnetic resonance imaging (MRI) market, by end-use, 2018 - 2030 (USD Million)

Table 44 Denmark magnetic resonance imaging (MRI) market, by architecture, 2018 - 2030 (USD Million)

Table 45 Denmark magnetic resonance imaging (MRI) market, by field strength, 2018 - 2030 (USD Million)

Table 46 Denmark magnetic resonance imaging (MRI) market, by application, 2018 - 2030 (USD Million)

Table 47 Denmark magnetic resonance imaging (MRI) market, by end-use, 2018 - 2030 (USD Million)

Table 48 Norway magnetic resonance imaging (MRI) market, by architecture, 2018 - 2030 (USD Million)

Table 49 Norway magnetic resonance imaging (MRI) market, by field strength, 2018 - 2030 (USD Million)

Table 50 Norway magnetic resonance imaging (MRI) market, by application, 2018 - 2030 (USD Million)

Table 51 Norway magnetic resonance imaging (MRI) market, by end-use, 2018 - 2030 (USD Million)

Table 52 Asia Pacific magnetic resonance imaging (MRI) market, by region, 2018 - 2030 (USD Million)

Table 53 Asia Pacific magnetic resonance imaging (MRI) market, by architecture, 2018 - 2030 (USD Million)

Table 54 Asia Pacific magnetic resonance imaging (MRI) market, by field strength, 2018 - 2030 (USD Million)

Table 55 Asia Pacific magnetic resonance imaging (MRI) market, by application, 2018 - 2030 (USD Million)

Table 56 Asia Pacific magnetic resonance imaging (MRI) market, by end-use, 2018 - 2030 (USD Million)

Table 57 China magnetic resonance imaging (MRI) market, by architecture, 2018 - 2030 (USD Million)

Table 58 China magnetic resonance imaging (MRI) market, by field strength, 2018 - 2030 (USD Million)

Table 59 China magnetic resonance imaging (MRI) market, by application, 2018 - 2030 (USD Million)

Table 60 China magnetic resonance imaging (MRI) market, by end-use, 2018 - 2030 (USD Million)

Table 61 India magnetic resonance imaging (MRI) market, by architecture, 2018 - 2030 (USD Million)

Table 62 India magnetic resonance imaging (MRI) market, by field strength, 2018 - 2030 (USD Million)

Table 63 India magnetic resonance imaging (MRI) market, by application, 2018 - 2030 (USD Million)

Table 64 India magnetic resonance imaging (MRI) market, by end-use, 2018 - 2030 (USD Million)

Table 65 Japan magnetic resonance imaging (MRI) market, by architecture, 2018 - 2030 (USD Million)

Table 66 Japan magnetic resonance imaging (MRI) market, by field strength, 2018 - 2030 (USD Million)

Table 67 Japan magnetic resonance imaging (MRI) market, by application, 2018 - 2030 (USD Million)

Table 68 Japan magnetic resonance imaging (MRI) market, by end-use, 2018 - 2030 (USD Million)

Table 69 Thailand magnetic resonance imaging (MRI) market, by architecture, 2018 - 2030 (USD Million)

Table 70 Thailand magnetic resonance imaging (MRI) market, by field strength, 2018 - 2030 (USD Million)

Table 71 Thailand magnetic resonance imaging (MRI) market, by application, 2018 - 2030 (USD Million)

Table 72 Thailand magnetic resonance imaging (MRI) market, by end-use, 2018 - 2030 (USD Million)

Table 73 South Korea magnetic resonance imaging (MRI) market, by architecture, 2018 - 2030 (USD Million)

Table 74 South Korea magnetic resonance imaging (MRI) market, by field strength, 2018 - 2030 (USD Million)

Table 75 South Korea magnetic resonance imaging (MRI) market, by application, 2018 - 2030 (USD Million)

Table 76 South Korea magnetic resonance imaging (MRI) market, by end-use, 2018 - 2030 (USD Million)

Table 77 Australia magnetic resonance imaging (MRI) market, by architecture, 2018 - 2030 (USD Million)

Table 78 Australia magnetic resonance imaging (MRI) market, by field strength, 2018 - 2030 (USD Million)

Table 79 Australia magnetic resonance imaging (MRI) market, by application, 2018 - 2030 (USD Million)

Table 80 Australia magnetic resonance imaging (MRI) market, by end-use, 2018 - 2030 (USD Million)

Table 81 Latin America magnetic resonance imaging (MRI) market, by region, 2018 - 2030 (USD Million)

Table 82 Latin America magnetic resonance imaging (MRI) market, by architecture, 2018 - 2030 (USD Million)

Table 83 Latin America magnetic resonance imaging (MRI) market, by field strength, 2018 - 2030 (USD Million)

Table 84 Latin America magnetic resonance imaging (MRI) market, by application, 2018 - 2030 (USD Million)

Table 85 Latin America brain and neurological MRI market, by field strength, 2018 - 2030 (USD Million)

Table 86 Latin America spine & musculoskeletal MRI market, by field strength, 2018 - 2030 (USD Million)

Table 87 Latin America vascular MRI market, by field strength, 2018 - 2030 (USD Million)

Table 88 Latin America abdominal MRI market, by field strength, 2018 - 2030 (USD Million)

Table 89 Latin America cardiac MRI market, by field strength, 2018 - 2030 (USD Million)

Table 90 Latin America breast MRI market, by field strength, 2018 - 2030 (USD Million)

Table 91 Latin America others MRI market, by field strength, 2018 - 2030 (USD Million)

Table 92 Latin America magnetic resonance imaging (MRI) market, by end-use, 2018 - 2030 (USD Million)

Table 93 Brazil magnetic resonance imaging (MRI) market, by architecture, 2018 - 2030 (USD Million)

Table 94 Brazil magnetic resonance imaging (MRI) market, by field strength, 2018 - 2030 (USD Million)

Table 95 Brazil magnetic resonance imaging (MRI) market, by application, 2018 - 2030 (USD Million)

Table 96 Brazil magnetic resonance imaging (MRI) market, by end-use, 2018 - 2030 (USD Million)

Table 97 Mexico magnetic resonance imaging (MRI) market, by architecture, 2018 - 2030 (USD Million)

Table 98 Mexico magnetic resonance imaging (MRI) market, by field strength, 2018 - 2030 (USD Million)

Table 99 Mexico magnetic resonance imaging (MRI) market, by application, 2018 - 2030 (USD Million)

Table 100 Mexico magnetic resonance imaging (MRI) market, by end-use, 2018 - 2030 (USD Million)

Table 101 Argentina magnetic resonance imaging (MRI) market, by architecture, 2018 - 2030 (USD Million)

Table 102 Argentina magnetic resonance imaging (MRI) market, by field strength, 2018 - 2030 (USD Million)

Table 103 Argentina magnetic resonance imaging (MRI) market, by application, 2018 - 2030 (USD Million)

Table 104 Argentina magnetic resonance imaging (MRI) market, by end-use, 2018 - 2030 (USD Million)

Table 105 MEA magnetic resonance imaging (MRI) market, by region, 2018 - 2030 (USD Million)

Table 106 MEA magnetic resonance imaging (MRI) market, by architecture, 2018 - 2030 (USD Million)

Table 107 MEA magnetic resonance imaging (MRI) market, by field strength, 2018 - 2030 (USD Million)

Table 108 MEA magnetic resonance imaging (MRI) market, by application, 2018 - 2030 (USD Million)

Table 109 MEA magnetic resonance imaging (MRI) market, by end-use, 2018 - 2030 (USD Million)

Table 110 South Africa magnetic resonance imaging (MRI) market, by architecture, 2018 - 2030 (USD Million)

Table 111 South Africa magnetic resonance imaging (MRI) market, by field strength, 2018 - 2030 (USD Million)

Table 112 South Africa magnetic resonance imaging (MRI) market, by application, 2018 - 2030 (USD Million)

Table 113 South Africa magnetic resonance imaging (MRI) market, by end-use, 2018 - 2030 (USD Million)

Table 114 Saudi Arabia magnetic resonance imaging (MRI) market, by architecture, 2018 - 2030 (USD Million)

Table 115 Saudi Arabia magnetic resonance imaging (MRI) market, by field strength, 2018 - 2030 (USD Million)

Table 116 Saudi Arabia magnetic resonance imaging (MRI) market, by application, 2018 - 2030 (USD Million)

Table 117 Saudi Arabia magnetic resonance imaging (MRI) market, by end-use, 2018 - 2030 (USD Million)

Table 118 Kuwait magnetic resonance imaging (MRI) market, by architecture, 2018 - 2030 (USD Million)

Table 119 Kuwait magnetic resonance imaging (MRI) market, by field strength, 2018 - 2030 (USD Million)

Table 120 Kuwait magnetic resonance imaging (MRI) market, by application, 2018 - 2030 (USD Million)

Table 121 Kuwait magnetic resonance imaging (MRI) market, by end-use, 2018 - 2030 (USD Million)

Table 122 UAE magnetic resonance imaging (MRI) market, by architecture, 2018 - 2030 (USD Million)

Table 123 UAE magnetic resonance imaging (MRI) market, by field strength, 2018 - 2030 (USD Million)

Table 124 UAE magnetic resonance imaging (MRI) market, by application, 2018 - 2030 (USD Million)

Table 125 UAE magnetic resonance imaging (MRI) market, by end-use, 2018 - 2030 (USD Million)

List of Figures

Fig. 1 Market research process

Fig. 2 Data triangulation techniques

Fig. 3 Primary research pattern

Fig. 4 Primary interviews in North America

Fig. 5 Primary interviews in Europe

Fig. 6 Primary interviews in APAC

Fig. 7 Primary interviews in Latin America

Fig. 8 Primary interviews in MEA

Fig. 9 Market research approaches

Fig. 10 Value-chain-based sizing & forecasting

Fig. 11 QFD modeling for market share assessment

Fig. 12 Market formulation & validation

Fig. 13 Magnetic resonance imaging (MRI) market: market outlook

Fig. 14 Magnetic resonance imaging (MRI) market competitive insights

Fig. 15 Parent market outlook

Fig. 16 Related/ancillary market outlook

Fig. 17 Penetration and growth prospect mapping

Fig. 18 Industry value chain analysis

Fig. 19 Magnetic resonance imaging (MRI) market driver impact

Fig. 20 Magnetic resonance imaging (MRI) market restraint impact

Fig. 21 Magnetic resonance imaging (MRI) market strategic initiatives analysis

Fig. 22 Magnetic resonance imaging (MRI) market: architecture movement analysis

Fig. 23 Magnetic resonance imaging (MRI) market: architecture outlook and key takeaways

Fig. 24 Closed system market estimates and forecast, 2018 - 2030

Fig. 25 Open system market estimates and forecast, 2018 - 2030

Fig. 26 Magnetic resonance imaging (MRI) market: field strength movement analysis

Fig. 27 Magnetic resonance imaging (MRI) market: field strength outlook and key takeaways

Fig. 28 Low field strength market estimates and forecast, 2018 - 2030

Fig. 29 Mid field strength market estimates and forecast, 2018 - 2030

Fig. 30 High field strength market estimates and forecast, 2018 - 2030

Fig. 31 Magnetic resonance imaging (MRI) market: application movement analysis

Fig. 32 Magnetic resonance imaging (MRI) market: application outlook and key takeaways

Fig. 33 Obstructive sleep apnea market estimates and forecast, 2018 - 2030

Fig. 34 Brain & neurological market estimates and forecast, 2018 - 2030

Fig. 35 Spine & musculoskeletal market estimates and forecast, 2018 - 2030

Fig. 36 Vascular market estimates and forecast, 2018 - 2030

Fig. 37 Abdominal market estimates and forecast, 2018 - 2030

Fig. 38 Cardiac market estimates and forecast, 2018 - 2030

Fig. 39 Breast market estimates and forecast, 2018 - 2030

Fig. 40 Others market estimates and forecast, 2018 - 2030

Fig. 41 Magnetic resonance imaging (MRI) market: end-use movement analysis

Fig. 42 Magnetic resonance imaging (MRI) market: end-use outlook and key takeaways

Fig. 43 Hospitals market estimates and forecast, 2018 - 2030

Fig. 44 Imaging centers estimates and forecast, 2018 - 2030

Fig. 45 Ambulatory surgical centers estimate and forecast, 2018 - 2030

Fig. 46 Others estimates and forecast, 2018 - 2030

Fig. 47 Global magnetic resonance imaging (MRI) market: regional movement analysis

Fig. 48 Global magnetic resonance imaging (MRI) market: regional outlook and key takeaways

Fig. 49 Global market share and leading players

Fig. 50 North America market share and leading players

Fig. 51 Europe market share and leading players

Fig. 52 Asia Pacific market share and leading players

Fig. 53 Latin America market share and leading players

Fig. 54 Middle East & Africa market share and leading players

Fig. 55 North America: SWOT

Fig. 56 Europe SWOT

Fig. 57 Asia Pacific SWOT

Fig. 58 Latin America SWOT

Fig. 59 MEA SWOT

Fig. 60 North America, by country

Fig. 61 North America

Fig. 62 North America market estimates and forecast, 2018 - 2030

Fig. 63 U.S.

Fig. 64 U.S. market estimates and forecast, 2018 - 2030

Fig. 65 Canada

Fig. 66 Canada market estimates and forecast, 2018 - 2030

Fig. 67 Europe

Fig. 68 Europe. market estimates and forecast, 2018 - 2030

Fig. 69 UK

Fig. 70 UK market estimates and forecast, 2018 - 2030

Fig. 71 Germany

Fig. 72 Germany market estimates and forecast, 2018 - 2030

Fig. 73 France

Fig. 74 France market estimates and forecast, 2018 - 2030

Fig. 75 Italy

Fig. 76 Italy market estimates and forecast, 2018 - 2030

Fig. 77 Spain

Fig. 78 Spain market estimates and forecast, 2018 - 2030

Fig. 79 Denmark

Fig. 80 Denmark market estimates and forecast, 2018 - 2030

Fig. 81 Norway

Fig. 82 Norway market estimates and forecast, 2018 - 2030

Fig. 83 Asia Pacific

Fig. 84 Asia Pacific market estimates and forecast, 2018 - 2030

Fig. 85 China

Fig. 86 China market estimates and forecast, 2018 - 2030

Fig. 87 Japan

Fig. 88 Japan market estimates and forecast, 2018 - 2030

Fig. 89 India

Fig. 90 India market estimates and forecast, 2018 - 2030

Fig. 91 Thailand

Fig. 92 Thailand. market estimates and forecast, 2018 - 2030

Fig. 93 South Korea

Fig. 94 South Korea market estimates and forecast, 2018 - 2030

Fig. 95 Australia

Fig. 96 Australia market estimates and forecast, 2018 - 2030

Fig. 97 Latin America

Fig. 98 Latin America market estimates and forecast, 2018 - 2030

Fig. 99 Brazil

Fig. 100 Brazil market estimates and forecast, 2018 - 2030

Fig. 101 Mexico

Fig. 102 Mexico market estimates and forecast, 2018 - 2030

Fig. 103 Argentina

Fig. 104 Argentina market estimates and forecast, 2018 - 2030

Fig. 105 Middle East and Africa

Fig. 106 Middle East and Africa. market estimates and forecast, 2018 - 2030

Fig. 107 South Africa

Fig. 108 South Africa market estimates and forecast, 2018 - 2030

Fig. 109 Saudi Arabia

Fig. 110 Saudi Arabia market estimates and forecast, 2018 - 2030

Fig. 111 UAE

Fig. 112 UAE market estimates and forecast, 2018 - 2030

Fig. 113 Kuwait

Fig. 114 Kuwait market estimates and forecast, 2018 - 2030

Fig. 115 Participant categorization- magnetic resonance imaging (MRI) market

Fig. 116 Market share of key market players- magnetic resonance imaging (MRI) market

What questions do you have? Get quick response from our industry experts. Request a Free Consultation

Market Segmentation

The incidence and prevalence of chronic diseases such as cancer, neurodegenerative diseases, and cardiac diseases, is increasing globally. For instance, according to the International Agency for Research on Cancer, in 2020, more than 19.2 million new cancer cases were recorded globally. Similarly, as per the American Heart Association, the mortality related to cardiovascular diseases is very high, with around 17.3 million deaths registered per year. This death rate is projected to reach 23.6 million by 2030. These diseases require imaging tools, such as MRI, for diagnosis and monitoring of progression as well as treatment effects. There has been a significant increase in participation in sports in the last decade. Thus, incidence of sports injuries is rapidly increasing. For instance, as per The Johns Hopkins Medicine, around 30.0 million children & teens participate in sports and around 3.5 million sports injuries occur every year. Similarly, as per The Association for Safe International Road Travel (ASIRT), around 20 to 50 million people are injured or disabled due to road accidents. Thus, surge in number of sports and trauma injuries is boosting demand for MRI.

The development of new software enables faster scanning and simplifies imaging workflows. Recent advancements in magnetic resonance imaging have enabled the development of multicontrast and cardiac MRI, which are better imaging tools. Software updates allow users to upgrade their systems with a more enhanced workflow. For instance, in November 2021, Philips announced the launch of an AI-enabled MR imaging portfolio, which is intended to improve the efficiency and sustainability of radiology operations by speeding up MR exams, streamlining workflows, improving diagnostic quality, and ensuring the efficiency and sustainability of radiology operations. In July 2020, Siemens and Bayer presented Imaging System Interface (ISI) for MRI at European Congress of Radiology (ECR) 2020. ISI is a joint software and hardware technology developed by both the companies and is an injector scanner interface for MRI Suite. This scanner will help in addressing the challenges faced during conventional contrast enhanced dynamic MRI workflow and will improve patient experience.

Innovation and R&D result in an increase in the cost of medical imaging systems. Low- and middle-income countries face challenges in adopting imaging systems due to the high price of products, low disposable income, and presence of limited resources & facilities. The high cost of medical imaging systems prevents patients from gaining access as it increases the healthcare expenditure. Thus, despite the availability of these devices, the high cost may prevent their installation, and hence may limit the sale of products. However, if funds are provided by the government and are generated through various CSR initiatives by creating awareness, the impact of this restraint may be minimized.

This section will provide insights into the contents included in this magnetic resonance imaging market report and help gain clarity on the structure of the report to assist readers in navigating smoothly.

What questions do you have? Get quick response from our industry experts. Request a Free Consultation

A three-pronged approach was followed for deducing the magnetic resonance imaging market estimates and forecasts. The process has three steps: information procurement, analysis, and validation. The whole process is cyclical, and steps repeat until the estimates are validated. The three steps are explained in detail below:

Information procurement: Information procurement is one of the most extensive and important stages in our research process, and quality data is critical for accurate analysis. We followed a multi-channel data collection process for magnetic resonance imaging market to gather the most reliable and current information possible.

Analysis: We mine the data collected to establish baselines for forecasting, identify trends and opportunities, gain insight into consumer demographics and drivers, and so much more. We utilized different methods of magnetic resonance imaging market data depending on the type of information we’re trying to uncover in our research.

Market formulation and validation : We mine the data collected to establish baselines for forecasting, identify trends and opportunities, gain insight into consumer demographics and drivers, and so much more. We utilize different methods of data analysis depending on the type of information we’re trying to uncover in our research.

The magnetic resonance imaging market was categorized into five segments, namely architecture (Open system, Closed system), field strength (Low Field Strength, Mid Field Strength, High Field Strength), application (Obstructive Sleep Apnea, Brain and neurological, Spine and musculoskeletal, Vascular, Abdominal, Cardiac, Breast), end-use (Hospitals, Imaging Centers, Ambulatory Surgical Centers), and region (North America, Europe, Asia Pacific, Latin America, Middle East & Africa).

The magnetic resonance imaging market was segmented into architecture, field strength, application, end-use, and regions. The demand at a segment level was deduced using a funnel method. Concepts like the TAM, SAM, SOM, etc., were put into practice to understand the demand. We at GVR deploy three methods to deduce market estimates and determine forecasts. These methods are explained below:

The magnetic resonance imaging market was analyzed at a regional level. The global was divided into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa, keeping in focus variables like consumption patterns, export-import regulations, consumer expectations, etc. These regions were further divided into twenty-three countries, namely, the U.S.; Canada; the UK; Germany; Italy; France; Spain; Sweden; Denmark; Norway; China; India; Japan; Thailand; South Korea; Australia; Mexico; Brazil; Argentina; Saudi Arabia; South Africa; UAE; Kuwait.

All three above-mentioned market research methodologies were applied to arrive at regional-level conclusions. The regions were then summed up to form the global market.

The magnetic resonance imaging market was analyzed via companies operating in the sector. Analyzing these companies and cross-referencing them to the demand equation helped us validate our assumptions and conclusions. Key market players analyzed include:

Supply Side Estimates

Demand side estimates

GVR strives to procure the latest and unique information for reports directly from industry experts, which gives it a competitive edge. Quality is of utmost importance to us, therefore every year we focus on increasing our experts’ panel. Primary interviews are one of the critical steps in identifying recent market trends and scenarios. This process enables us to justify and validate our market estimates and forecasts to our clients. With more than 8,000 reports in our database, we have connected with some key opinion leaders across various domains, including healthcare, technology, consumer goods, and the chemical sector. Our process starts with identifying the right platform for a particular type of report, i.e., emails, LinkedIn, seminars, or telephonic conversation, as every report is unique and requires a differentiated approach.

We send out questionnaires to different experts from various regions/ countries, which is dependent on the following factors:

The time to start receiving responses from industry experts varies based on how niche or well-penetrated the market is. Our reports include a detailed chapter on the KoL opinion section, which helps our clients understand the perspective of experts already in the market space.

What questions do you have? Get quick response from our industry experts. Request a Free Consultation